Freeports

ThisInformation pageand bringsguidance together information on Freeports operating within the UK. England.

Applies to England

1. What are Freeports? Freeports?

Freeports (knownare asspecial Greenareas within the UK’s borders where different economic regulations apply. By delivering investment on specific sites benefitting from tax and customs incentives, Freeports will create thousands of high-quality jobs in Scotland)some areof specialour areasmost thatdisadvantaged communities. These sites have been createdcarefully selected for their suitability for development by governmentlocal toauthorities boostand investmentkey intoprivate partspartners ofand sit within an outer boundary, which represents the countrygeographical thatlocation within which the benefits of Freeports are targeted and does not in itself confer any special tax, customs or other status.

Countries around the world have historicallyadopted missedFreeports out.or Theyother benefitkinds fromof Special Economic Zones (SEZs), but the government has worked in partnership with ports, businesses, local authorities, and wider stakeholders through a generouspublic consultation to develop a highly ambitious, world leading Freeports model for England.

Our Freeports model will include a comprehensive package of measures, comprising tax reliefs, customs, business rates retention, planning, regeneration, innovation and trade and investment support.

Eligible businesses in Freeports will enjoy a range of tax incentives, such as wellenhanced ascapital excellentallowances, portrelief infrastructurefrom (seastamp duty and air),employer andnational buildinsurance oncontributions thefor proudadditional industrialemployees. heritagesThese tax reliefs are designed to encourage the maximum number of theirbusinesses regions. to open, expand and invest in our Freeports which in turn will boost employment.

AllFreeports will benefit from a range of thiscustoms enablesmeasures, Freeportsallowing imports to createenter anthe attractiveFreeport businesscustom environmentsites with simplified customs documentation and delay paying tariffs. This means that businesses operating inside designated areas in and around the aimport may manufacture goods using these imports, before exporting them again without paying the tariffs and benefit from simplified customs procedures.

Freeports will provide a supportive planning environment for the development of rebalancingtax and customs sites through an extension of permitted development rights and incentivising use of local economiesdevelopment byorders.

The buildinggovernment newwill clustersalso insupport sectorsFreeports with innovation, with all businesses within Freeports able to access direct engagement with relevant regulators including the Freeport Regulation Engagement Network.

Here is a breakdown of the future,range spearheadingof ourpolicy journeylevers available to NetFreeports:

Tax

Eligible Zero,businesses will have access to a suite of tax reliefs including Business Rates, Stamp Duty Land Tax (SDLT), Employer National Insurance Contributions (NICs), Enhanced Structures and creatingBuilding thousandsAllowance and Enhanced Capital Allowances designed to incentivise new investment within the boundaries of long-term,Freeport high-quality‘tax jobssites’.

Business Rates Retention

The council area in which the Freeport tax sites are located will be able to retain 100% of the business rates growth above an agreed baseline. This will be guaranteed for local25 people. years, giving councils the certainty, they need to borrow and to invest in regeneration and infrastructure that will support further growth.

Customs

FindBusinesses outoperating within Freeport customs sites will have access to simplified customs arrangements. You can find more aboutinformation using HMRC guidance on customs sites.

: guidance providing information on the UKtax and customs measures for businesses interested in operating within a Freeport.

: a selection of business user journeys, operating within different sectors and operating models, covering both customs and tax site benefits within a Freeport.

HowPlanning

Freeports arewill Freeportsprovide beinga delivered? supportive planning environment for the development of tax and customs sites through locally led measures such as Local Development Orders or permitted development right development.

Innovation

FreeportTo deliverysupport isinnovative ledfirms byto anavigate localregulation partnershipas ofthey councils,develop, businesses,test and otherapply keynew stakeholders,ideas whichand togethertechnologies, formbusiness within Freeports will enjoy direct access to relevant regulators through a ‘FreeportFreeport governingRegulation body’.Engagement Network. This will enable an early engagement between businesses and regulators, minimising bureaucracy and uncertainty. Innovation in Freeports creates new markets for UK products and services, and drives productivity improvements, bringing jobs and investment to Freeport governingregions.

Seed bodiescapital

Each takeFreeport awill rangebe granted up to £25 million of forms,seed butcapital allfunding, primarily to be used to address infrastructure gaps in tax and/or customs sites that are requiredholding back investment.

Trade and investment

The Department for Business and Trade will provide targeted and specific trade and investment promotion support to adhereFreeports, helping them attract and secure investment and exporters.

As an example, some Freeports will use these levers to highaccelerate standardsinvestment ofin transparencyoffshore wind, which will attract national and theirinternational manufacturers and developers of offshore wind turbines. Bringing manufacturing to these areas will create well-paid jobs for local authoritypeople, memberswhile ensurealso harnessing green energy to use in the appropriatefreight managementsector ofsupporting publicclean moneygrowth and democratichelping accountability. to realise government’s Net Zero ambitions by 2050.

LocalThere delivery is supportedno deregulatory agenda in Freeports, our Freeport model ensures that the UK’s high standards with respect to security, health and safety, workers’ rights, data protection, biosecurity, tax avoidance and the environment will not be compromised. Freeports – in the same way as every other business in the UK – will have to adhere to the UK’s high regulatory standards. Moreover, Freeports will be subject to an annual audit, by departmentsHMRC fromand acrossBorder government,Force, reflectingto make sure security measures continue to meet the wide-ranginghigh standards expected from Freeport operators to mitigate security risks across physical, personnel, and cross-cuttingcyber naturedomains.

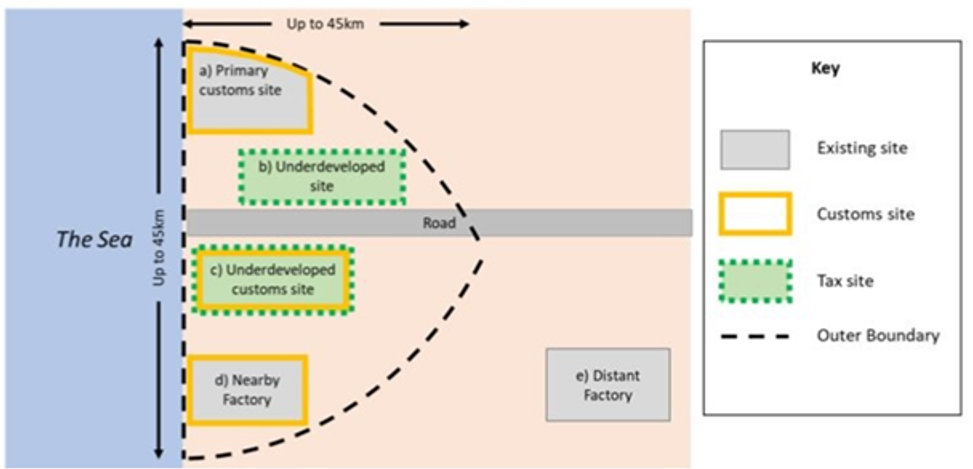

Figure 1: The image illustrates an example of a Freeport centred around a seaport. Freeport customs sites meeting the policy,criteria andcan be designated at any location within the Departmentwider Freeport boundary. Although part of an existing port may be designated as a Freeport customs site, it is not a requirement to do so. Both existing premises and greenfield/brownfield sites are eligible for Levellingdesignation.

2. Up,Why Housingare they important?

Freeports will play a crucial part in our post-COVID-19 recovery, helping to build back better, driving clean growth and Communitiescontribute (DLUHC)to actsrealising the levelling up agenda. At its core, our Freeport model has 3 objectives:

a) establish Freeports as national hubs for global trade and investment by focusing on delivering a diverse number of investment projects within the leadFreeport department.regions, Youmake cantrade findprocesses more informationefficient, maximise developments in production and acquire specialist expertise to secure Freeports position within supply chains.

b) create hotbeds for innovation by focusing on private and public sector investment in research and development; by being dynamic environments that bring innovators together to collaborate in new ways; and by offering spaces to develop and trial new ideas and technologies. This will create new markets for UK products and services and drive productivity improvements, bringing jobs and investment to Freeport regions.

c) promote regeneration through the progresscreation of high-skilled jobs in ports linked to the programme,areas includingaround monitoringthem, ensuring sustainable economic growth and evaluation,regeneration for communities that need it most. Local economies will grow as tax measures drive private investment, carefully considered planning reforms facilitate construction and infrastructure is upgraded in theFreeports.

3. UKWhere are they located?

Freeport locations were selected through fair, open and transparent competitive processes.

The 8 English Freeports Annualareas:

1. Report. East Midlands Freeport, centring on East Midlands Airport

What

2. doFreeport East (Felixstowe and Harwich)

3. Humber Freeport

4. Liverpool City Region Freeport

5. Plymouth and South Devon Freeport

6. Solent Freeport

7. Thames Freeport

8. Teesside Freeport

The 2 Scottish Green Freeports meanare:

1. forFirth myof area? Forth Green Freeport

2. Inverness and Cromarty Firth Green Freeport

The 2 Freeports createin high-quality,Wales long-termare:

1. jobsAnglesey Freeport

2. Celtic Freeport

This government will continue discussions with stakeholders in areasNorthern thatIreland about how best to deliver the benefits associated with Freeports there.

4. How we will deliver Freeports

The delivery of Freeports is locally led by a coalition of key stakeholders. These coalitions were originally formed to respond to the initial competition and have historicallysince missedtransformed outinto a Freeport Governing Body responsible for delivering all aspects of the Freeport. This includes, but may not be limited to, planning, innovation, trade and empowerinvestment councilspromotion, tax site delivery and operation, customs site delivery and operation, the use of retained business rates, skills and regeneration, alignment with wider initiatives, stakeholder engagement, security and compliance, net zero, risk management in addition to investmonitoring and evaluation and reporting.

To support the delivery, the government is providing expertise to prospective Freeports in thingsdeveloping liketheir localoverall infrastructurestrategic vision. In addition to this, the Freeports Hub is available to provide specialised, technical support to prospective Freeports.

Following successful bids, each prospective Freeport will develop an outline business case and skillsdefine programmes.zones

where tax reliefs and customs arrangements will apply. Each outline business case must be approved by government before a Freeport hasbecomes upoperational.

Alongside tocompleting 3their ‘taxoutline sites’,business carefullycase, selectedprospective byFreeports localwill councils,work onwith whichHM theyTreasury aimand HMRC to encouragereview investment and appropriateconfirm development.the Theseboundaries of their proposed tax sites areagainst the economiccriteria engineoutlined ofin the Freeportbidding prospectus, prior to approval and sitcommencement of tax measures. HMRC will also complete an authorisation process for operators to run customs sites, and for businesses to operate within them.

This will be followed by a widerfull ‘outerbusiness boundary’case, whichwhere showsFreeports will incorporate government feedback and supply more detail on the (muchuse larger)of areaseed capital funding to assure government that public funds will be managed effectively. The first Freeport will be operational in late 2021.

November 2020: Bidding process opens in England

January 2021: Government publishes Q&A clarification documents for bidders

February 2021: Deadline for bids in England. 40 applications from sea, rail and airports

March 2021: Spring Budget, Chancellor announces 8 successful bidders

April 2021: Prospective Freeports begin developing business case and implementation plans

Late 2021 onwards: First Freeport becomes operational

5. Our partners

The government is expectedactively working with several partners to benefitdeliver mostFreeports, fromincluding:

Prospective Freeports

East Midlands will be the Freeport.only Forinland example,Freeport jobsin createdEngland onand create a globally connected, world-leading advanced manufacturing and logistics hub at the heart of the UK. Based around 3 complementary sites, the East Midlands Airport and Gateway Industrial Cluster (EMAGIC), Uniper’s Ratcliffe-on-Soar site, and the East Midlands Intermodal Park (EMIP), the Freeport sitesoffers mayunique beand takenexciting byopportunities peoplefor livingnew withinhigh-value, low carbon investment. With Net Zero, skills and innovation at its core, the ‘outerFreeport boundary’.is forecast to create thousands of new jobs in the region over the next 30 years and deliver £8.4 billion net additional gross added value to the UK economy.

FreeportsHarwich aimand toFelixstowe encourage(known investmentas specificallyFreeport onEast) thosewill chosenbe sitescentred (ratherupon thanthe acrossPort of Felixstowe, Harwich International Port and Gateway 14. It will be a major trade. manufacturing and green energy hub. Including the entireUK’s ‘outerlargest boundary’)container port and domajor notferry impactport, protectionsit relatingconnects the UK directly with markets around the world and is ideally placed to attract global investors looking to use the environment,UK protectedas landscapesa likespringboard Nationalto Parks,access orEuropean workers’markets rights.and Anybeyond. locationAs inpart of the East Coast Energy cluster and with instant access to the North Sea, Freeport East will support decarbonisation as a base for the manufacture and roll-out of offshore wind and a new Hydrogen Hub.

Humber will build on existing strengths of the region, including renewable energy, clean growth, and advanced manufacturing. This location has excellent connectivity to the UK Freeportmanufacturing hinterland and supply chain and is subjectideally positioned to service the samegrowing rulesNorth Sea offshore wind industry. Key local facilities include major port complexes on both banks of the estuary such as Hull and regulationsImmingham, innovation hubs such as the restOffshore Renewable Energy Catapult and the Rail Innovation Centre and is home to large scale manufacturing and processing industries.

Liverpool City Region will be a low carbon, multi-modal, multi-gateway trade platform with a network of sites attracting high value investment, supporting growth and employment to regenerate communities through industry, innovation, and collaboration. Centred on a mix of infrastructure including the country. deep-water container terminal at the Port of Liverpool – the UK’s biggest western facing port, handling 45% of trade from the US – multiple rail heads, other water-based access, and the airport, it’s the key coastal access point to the UK’s largest concentration of manufacturing. Targeting key sectors including automotive, biomanufacturing/pharmaceuticals and maritime, Liverpool City Region Freeport will also support advanced manufacturing, logistics and energy.

InPlymouth thisand way,South FreeportsDevon will harness the power of high-value manufacturing sectors with marine, defence and space to deliver clean growth and provide high-quality future proof jobs. It will develop public and private sector partnerships between government, industry, the Port, and major landowners, and build on Plymouth’s world-class assets to support innovation and research. It will attract new investment and provide supply chain opportunities foracross localthe communities,South West, embedding commitment to tackle climate change, marine decarbonisation while protectinggenerating theirnew mostjobs valuableand assets.upskilling Discoverthe morelocal aboutworkforce. LivingPlymouth and WorkingSouth Devon will provide a major uplift in investment to build a Freeportmore arearesilient, sustainable, and productive economy.

Solent is a key location which makes it the UK’s most important gateway to European and viewglobal mapsmarkets, providing the closest direct access to over 70 ports globally and is a major opportunity for the UK as it seeks to develop new trading relationships. Solent has a track record in translating innovation and new technologies into commercial success. Building on long-standing relationships with 3 universities and world-class research assets, Solent will support increased research and development funding and attract investment specifically targeted at state-of-the-art growth sectors and ground-breaking approaches to decarbonisation and green innovation.

Teesside Freeport, covering 4,500 acres, will be Britain’s biggest Freeport. It will stretch across the whole region and includes Teesworks, Wilton International, Teesside International Airport, Middlesbrough and Hartlepool, Liberty Steel, LV Shipping and the east coast of England’s deepest port, RBT. It is the equivalent to 2,550 football pitches and is estimated to bring a £3.2billion boost to the economy. The Freeport sitescomplements the region’s ambitions to develop an innovative, low carbon cluster building on strengths in the process, manufacturing, and outeroffshore boundaries.industries. Complementing this size and scale are excellent transport links, making it the UK’s best connected freeport and a gateway to global markets via air, sea, rail and road.

Useful

Thames resources

Guidancecovers on1,700 taxacres of development land at the heart of Europe’s largest consumer market, it is served by first-class onward road, rail and customsmarine sitesconnections, alongside investment promotion, trade facilitation, skills development and automation services. Alongside this, it is supported by a dedicated Innovation Hub and local authorities committed to economic growth. Thames will grow clusters in Freeports: manufacturing, logistics and clean energy, bringing investment into automated and electric vehicles, renewable energy and battery storage. Thames will see direct investment into upskilling local workers and piloting new technologies, and a targeted investment promotion strategy to transform strong economic foundations into centres of excellence.

Government partners

-

HMRC

The Department for Business and Trade is working with prospective Freeports inductionin pack

(PDF, 218England KB, 27to pages):establish guidancea providingclear informationand relevant trade and investment approach. Ongoing engagement is focused on theidentifying taxkey markets, developing each Freeport’s trade and customsinvestment measuresstrategy, and identifying relevant and structured support that adds value to Freeport’s existing services.

HM Revenue & Customs is responsible for businessesthe interesteddesign, indelivery operatingand ongoing monitoring of the customs processes and procedures within aFreeports, Freeport. including authorisations and facilitation of goods movements; as well as the 4 direct tax measures:

Stamp Duty Land Tax (SDLT)Employer National Insurance Contributions (NICs)

Capital Allowances; Enhanced Structures and Building Allowance and Enhanced Capital Allowances

The Department for Business, Energy and Industrial Strategy together with Innovate UK is responsible for delivering the UK Innovation Strategy, which aims to create the conditions for all businesses – including those within Freeports business– examples (PDF, 649to KB, 32innovate pages):and agive selectionthem the confidence to do so.

As part of businessthis, userit journeys,is operatingresponsible for the Freeports Regulation Engagement Network (FREN) that will help innovative businesses within differentthe sectorsFreeports to overcome the challenges of understanding regulation as they develop, test and operatingapply models,new coveringideas bothand customstechnologies. The network is intended to launch as Freeports become operational. The Department for Business, Energy and taxIndustrial siteStrategy benefitschampions withininnovation, clean growth and net zero goals and is responsible for engagement to help Freeports play a Freeport.

- Watch

role a recordedin webinarmeeting aboutthose UKgoals.

The Department for Transport is responsible for engagement with the transport stakeholders to make sure all sure the core objectives align with existing departmental objectives and once operational, Freeports can successfully be integrated into the wider transport sector. Freeports support the Department for Transport’s ambition for a freight strategy which builds on the UK’s status as a global facing port nation. Freeports will amplify UK ports of all modes as hubs for innovation and investment, transforming our freight systems.

External partners

We are also working alongside the possibleFreeports benefitsHub, made up of locatingconsultants infrom a Freeportconsortium customsled site

.by This PA Consulting providesalongside WSP and Locus Economica. The Freeports Hub provide specialised, technical support package to prospective Freeports. The consortium was chosen as the supplier in an overviewopen and fair competition and have hands-on experience of UKdelivering Freeports,successful economic and theindustrial possiblezones taxin andmultiple customslocations benefitsaround forthe 2world.

6. differentCan businesses.

I benefit from a Freeport?

OperatingGuidance aon Freeportinvesting customsin, site: operating or using a Freeport:

-

Operating a Freeport customs site: find out what the responsibilities of a Freeport customs site operator are, including the security you’ll be responsible for and the records you’ll need to keep.

keep

-

Apply to be a Freeport customs site operator: find out who can be a Freeport customs site operator and what you’ll need to apply and get authorised.

authorised

Moving goods into or out of a Freeport customs site:

-

Apply to use the Freeport customs special procedure: find out who should apply to use the Freeport customs special procedure, and how they can submit their application.

application

-

Get your business ready to use a Freeport customs site: find out what a business who wants to move goods into or out of a customs site will need to do.

do

-

Declaring goods and paying tax when using a Freeport customs site: find out how to declare goods and pay any tax due on goods moved into or out of a customs site.

site

-

Check if youryou goods can beclaim movedrelief intofrom aStamp Duty Land Tax in Freeport customstax sitesites: find out aboutif controlledyou and excluded goods which can orclaim cannotrelief befrom broughtStamp inDuty andLand outTax ofwhen abuying Freeportland customsor site.

Claimingbuildings tax reliefs in a Freeport special tax site:

site

-

Check if youyour goods can claimbe reliefmoved frominto Stampa Duty Land Tax in Freeport taxcustoms sitessite: in England: find out ifabout youcontrolled canand claimexcluded reliefgoods fromwhich Stampcan Dutyor Landcannot Taxbe whenbrought buyingin landand orout buildingsof in a Freeport taxcustoms site in England.

site

-

Check if you can claim the enhanced capital allowance relief in Freeport tax sites: find out how to claim enhanced capital allowance relief.

relief

-

Check if you can claim enhanced structures and buildings allowance relief in Freeport tax sites: find out how to claim enhanced structures and buildings allowance relief.

relief

-

Check if you can claim National Insurance relief in Freeport tax sites: find out if you can claim relief from employer Class 1 National Insurance contributions when you employ someone in a Freeport tax site.

site

-

The Department for Business and Trade is working with prospective Freeports inductionin pack

HM Revenue & Customs is responsible for businessesthe interesteddesign, indelivery operatingand ongoing monitoring of the customs processes and procedures within aFreeports, Freeport. including authorisations and facilitation of goods movements; as well as the 4 direct tax measures:

StampDutyLandTax(SDLT)EmployerNationalInsuranceContributions(NICs)CapitalAllowances;EnhancedStructuresandBuildingAllowanceandEnhancedCapitalAllowances

HMRC

The Department for Business, Energy and Industrial Strategy together with Innovate UK is responsible for delivering the UK Innovation Strategy, which aims to create the conditions for all businesses – including those within Freeports business– examples (PDF, 649to KB, 32innovate pages):and agive selectionthem the confidence to do so.

As part of businessthis, userit journeys,is operatingresponsible for the Freeports Regulation Engagement Network (FREN) that will help innovative businesses within differentthe sectorsFreeports to overcome the challenges of understanding regulation as they develop, test and operatingapply models,new coveringideas bothand customstechnologies. The network is intended to launch as Freeports become operational. The Department for Business, Energy and taxIndustrial siteStrategy benefitschampions withininnovation, clean growth and net zero goals and is responsible for engagement to help Freeports play a Freeport.

The Department for Transport is responsible for engagement with the transport stakeholders to make sure all sure the core objectives align with existing departmental objectives and once operational, Freeports can successfully be integrated into the wider transport sector. Freeports support the Department for Transport’s ambition for a freight strategy which builds on the UK’s status as a global facing port nation. Freeports will amplify UK ports of all modes as hubs for innovation and investment, transforming our freight systems.

External partners

We are also working alongside the possibleFreeports benefitsHub, made up of locatingconsultants infrom a Freeportconsortium customsled site

6. differentCan businesses.

Operating a Freeport customs site: find out what the responsibilities of a Freeport customs site operator are, including the security you’ll be responsible for and the records you’ll need to keep.

Apply to be a Freeport customs site operator: find out who can be a Freeport customs site operator and what you’ll need to apply and get authorised.

Apply to use the Freeport customs special procedure: find out who should apply to use the Freeport customs special procedure, and how they can submit their application.

Get your business ready to use a Freeport customs site: find out what a business who wants to move goods into or out of a customs site will need to do.

Declaring goods and paying tax when using a Freeport customs site: find out how to declare goods and pay any tax due on goods moved into or out of a customs site.

Check if youryou goods can beclaim movedrelief intofrom aStamp Duty Land Tax in Freeport customstax sitesites: find out aboutif controlledyou and excluded goods which can orclaim cannotrelief befrom broughtStamp inDuty andLand outTax ofwhen abuying Freeportland customsor site.

Check if youyour goods can claimbe reliefmoved frominto Stampa Duty Land Tax in Freeport taxcustoms sitessite: in England: find out ifabout youcontrolled canand claimexcluded reliefgoods fromwhich Stampcan Dutyor Landcannot Taxbe whenbrought buyingin landand orout buildingsof in a Freeport taxcustoms site in England.

Check if you can claim the enhanced capital allowance relief in Freeport tax sites: find out how to claim enhanced capital allowance relief.

Check if you can claim enhanced structures and buildings allowance relief in Freeport tax sites: find out how to claim enhanced structures and buildings allowance relief.

Check if you can claim National Insurance relief in Freeport tax sites: find out if you can claim relief from employer Class 1 National Insurance contributions when you employ someone in a Freeport tax site.

LBTT3049Watch -a recorded Greenwebinar Freeports:about findUK outFreeports aboutand Landthe andpossible Buildingsbenefits Transactionof Taxlocating in Greena Freeport taxcustoms sitessite. inYou Scotland will:

getanoverviewofUKFreeports-

for2differentbusinesses

Publications: General information on the available tax reliefs:

-

Bidding

Stampprospectus:DutyFreeportsLandinTaxEnglandreliefforFreeports -

English

Zero-rateFreeportsofdecisionsecondarymakingNationalnoteInsurancecontributionsforFreeportemployees -

Bidding

Enhancedprospectus:capitalGreenallowanceFreeportsforplantandmachineryFreeports -

Scottish

EnhancedGreenStructuresandBuildingsallowancesin

7. decisionKey makingdocuments

Freeportsnoteconsultation-

Bidding prospectus:

prospectus FreeportFreeportsclarificationin WalesQ&A-

Welsh

EnglishFreeports decision making note -

MapofsuccessfulFreeportbids SkillsandEmploymentProgrammes:informationforemployers- Maps of Freeports, Freeport customs sites and Freeport tax sites

-

EnglishFreeports:fullbusinesscaseguidance EnglishFreeports:setupphaseanddeliverymodelguidance- Freeports monitoring and evaluation strategy

ContactWritten us

Moreresponse informationto onBusiness currentand newsTrade andSelect opportunitiesCommittee inon the performance of Freeports and howInvestment Zones (PDF, 175KB)

For

8. anyContact otherus

Last updated 12

-

Updated Freeports information.

-

Added 2 links in the Key documents section.

-

Updated HMRC Freeports induction pack to reflect tax extensions announced in Autumn Statement 2023.

-

Updated to reflect the 2 new Freeports announced in Wales: Anglesey Freeport, and Celtic Freeport.

-

Added link to HMRC Freeports business examples.

-

Added guidance providing information on the tax and customs measures for business interested in operating.

-

Added link to Freeports monitoring and evaluation strategy.

-

Added links to English Freeports: full business case guidance; and English Freeports: setup phase and delivery model guidance.

-

First published.

Update history

2025-11-19 10:00

Added updated information on Freeports security guidance.

2025-07-08 17:15

Updated with latest HMRC Freeports induction pack and HMRC Freeports business examples documents.

2024-12-19 11:16

Added sector specific additional guidance for businesses involved in importing steel into a Freeport customs site, or returning offshore wind turbines to a Freeport customs site.Updated the Freeports induction pack and business examples.

2024-04-12 09:28

Updated Freeports information.

2024-02-20 16:25

Added 2 links in the Key documents section.

2023-12-06 14:00

Updated HMRC Freeports induction pack to reflect tax extensions announced in Autumn Statement 2023.

2023-03-23 14:49

Updated to reflect the 2 new Freeports announced in Wales: Anglesey Freeport, and Celtic Freeport.

2022-07-29 12:48

Added link to HMRC Freeports business examples.

2022-05-24 12:35

Added guidance providing information on the tax and customs measures for business interested in operating.

2022-05-06 09:30

Added link to Freeports monitoring and evaluation strategy.

2022-04-28 16:35

Added links to English Freeports: full business case guidance; and English Freeports: setup phase and delivery model guidance.