Business Asset Roll-over Relief (Self Assessment helpsheet HS290)

Find out how to claim Business Asset Roll-over Relief.

- From:

- HM Revenue & Customs

- Published

- 4 July 2014

- Last updated

-

6 April

20242025 — See all updates

Documents

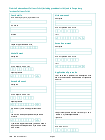

HS290 form (2024)(2025)

PDF, 171697 KB, 1 page

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

HS290 form (2023)(2024)

PDF, 169171 KB, 1 page

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

HS290 form (2022)(2023)

PDF, 165169 KB, 1 page

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

HS290 form (2021)(2022)

PDF, 164165 KB, 1 page

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

Details

This guide explains how to claim Business Asset Roll-over Relief and get relief for assets you’ve disposed of.

Updates to this page

Published 4 July 2014

Last updated 6 April 2024

+ show2025

href="#full-history">+ show all updates

-

Sign up for emails or print this page

Update history

2025-11-11 15:24

Updated ‘HS290 Business Asset Roll-over Relief (2025)’ helpsheet to clarify that there is no claim involved in obtaining provisional relief.

2025-11-03 15:17

A new version of the form for the 2024 to 2025 tax year has been added. It makes clear that you do not need to make a claim to get provisional relief, in line with recent updates to the Capital Gains Tax manual.

2025-04-06 00:15

A new helpsheet and claim form have been added for the 2024 to 2025 tax year. The 2021 helpsheet and claim form have been removed.

2024-04-06 00:15

A new helpsheet and claim form have been added for the 2023 to 2024 tax year. The 2020 helpsheet and claim form have been removed.

2023-04-06 00:15

A new helpsheet and claim form have been added for the 2022 to 2023 tax year. The 2019 helpsheet and claim form have been removed.

2022-04-06 00:15

A new helpsheet and claim form have been added for the 2021 to 2022 tax year. The 2018 helpsheet and claim form have been removed.

HS290 form (2024)(2025)

PDF, 171697 KB, 1 page

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

HS290 form (2023)(2024)

PDF, 169171 KB, 1 page

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

HS290 form (2022)(2023)

PDF, 165169 KB, 1 page

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

HS290 form (2021)(2022)

PDF, 164165 KB, 1 page

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

Details

This guide explains how to claim Business Asset Roll-over Relief and get relief for assets you’ve disposed of.

Updates to this page

Published 4 July 2014

Last updated 6 April 2024

+ show2025

href="#full-history">+ show all updates

-

Sign up for emails or print this page

Update history

2025-11-11 15:24

Updated ‘HS290 Business Asset Roll-over Relief (2025)’ helpsheet to clarify that there is no claim involved in obtaining provisional relief.

2025-11-03 15:17

A new version of the form for the 2024 to 2025 tax year has been added. It makes clear that you do not need to make a claim to get provisional relief, in line with recent updates to the Capital Gains Tax manual.

2025-04-06 00:15

A new helpsheet and claim form have been added for the 2024 to 2025 tax year. The 2021 helpsheet and claim form have been removed.

2024-04-06 00:15

A new helpsheet and claim form have been added for the 2023 to 2024 tax year. The 2020 helpsheet and claim form have been removed.

2023-04-06 00:15

A new helpsheet and claim form have been added for the 2022 to 2023 tax year. The 2019 helpsheet and claim form have been removed.

2022-04-06 00:15

A new helpsheet and claim form have been added for the 2021 to 2022 tax year. The 2018 helpsheet and claim form have been removed.

Details

This guide explains how to claim Business Asset Roll-over Relief and get relief for assets you’ve disposed of.

Updates to this page

Sign up for emails or print this page

Update history

2025-11-11 15:24

Updated ‘HS290 Business Asset Roll-over Relief (2025)’ helpsheet to clarify that there is no claim involved in obtaining provisional relief.

2025-11-03 15:17

A new version of the form for the 2024 to 2025 tax year has been added. It makes clear that you do not need to make a claim to get provisional relief, in line with recent updates to the Capital Gains Tax manual.

2025-04-06 00:15

A new helpsheet and claim form have been added for the 2024 to 2025 tax year. The 2021 helpsheet and claim form have been removed.

2024-04-06 00:15

A new helpsheet and claim form have been added for the 2023 to 2024 tax year. The 2020 helpsheet and claim form have been removed.

2023-04-06 00:15

A new helpsheet and claim form have been added for the 2022 to 2023 tax year. The 2019 helpsheet and claim form have been removed.

2022-04-06 00:15

A new helpsheet and claim form have been added for the 2021 to 2022 tax year. The 2018 helpsheet and claim form have been removed.