Relief for foreign tax paid (Self Assessment helpsheet HS263)

Use the Self Assessment helpsheet (HS263) to work out tax credit relief on income that you've paid foreign tax on.

- From:

- HM Revenue & Customs

- Published

- 4 July 2014

- Last updated

-

6 April

20242025 — See all updates

Documents

Working sheet 1 for income 20242025

PDF, 222220 KB, 3 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

Working sheet 2 for Capital Gains Tax 20242025

PDF, 307304 KB, 2 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

Working sheet 1 for income 20232024

PDF, 230222 KB, 3 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

Working sheet 2 for Capital Gains Tax 20232024

PDF, 314307 KB, 2 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

Working sheet 1 for income 20222023

PDF, 229230 KB, 3 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

Working sheet 2 for Capital Gains Tax 20222023

PDF, 298314 KB, 2 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

Working sheet 1 for income 20212022

PDF, 710229 KB, 63 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

Working sheet 2 for Capital Gains Tax 20212022

PDF, 778298 KB, 2 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a version of this document in a more accessible format, please email different.format@hmrc.gov.uk. Please tell us what format you need. It will help us if you say what assistive technology you use.

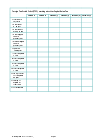

Details

If you’ve already paid foreign tax on your income which is also chargeable to UK tax, use this guide to work out how to claim Foreign Tax Credit Relief.

The guide can also help with foreign dividends and reliefs against Capital Gains Tax.

Details

If you’ve already paid foreign tax on your income which is also chargeable to UK tax, use this guide to work out how to claim Foreign Tax Credit Relief.

The guide can also help with foreign dividends and reliefs against Capital Gains Tax.